-

Category

Insurance

-

Business Model

B2B

-

Website

-

Contact Person

Andrew Lai

-

Business Email

-

Business Phone Number

-

Founded

2004

Pitch

At Anapi, we’re on a mission to help investors, startups and entrepreneurs get the protection and advice they need against their evolving business risks, so they can have the peace of mind to grow their business.

We are speciality insurance brokers regulated by the Monetary Authority of Singapore. With over 20 years of experience, we work with our network of insurers to protect our clients from both emerging and known risks. We manage over 7 million in premiums from our 1,000-plus clients, ranging from regional corporates, early-stage startups or fast-growing unicorns, and the funds or vendors that support them.

We understand the unique and complex challenges faced by businesses as they grow, and we are committed to offering insurance coverage to mitigate those risks – quickly, efficiently and affordably.

Problem/Opportunity and Solution/Product

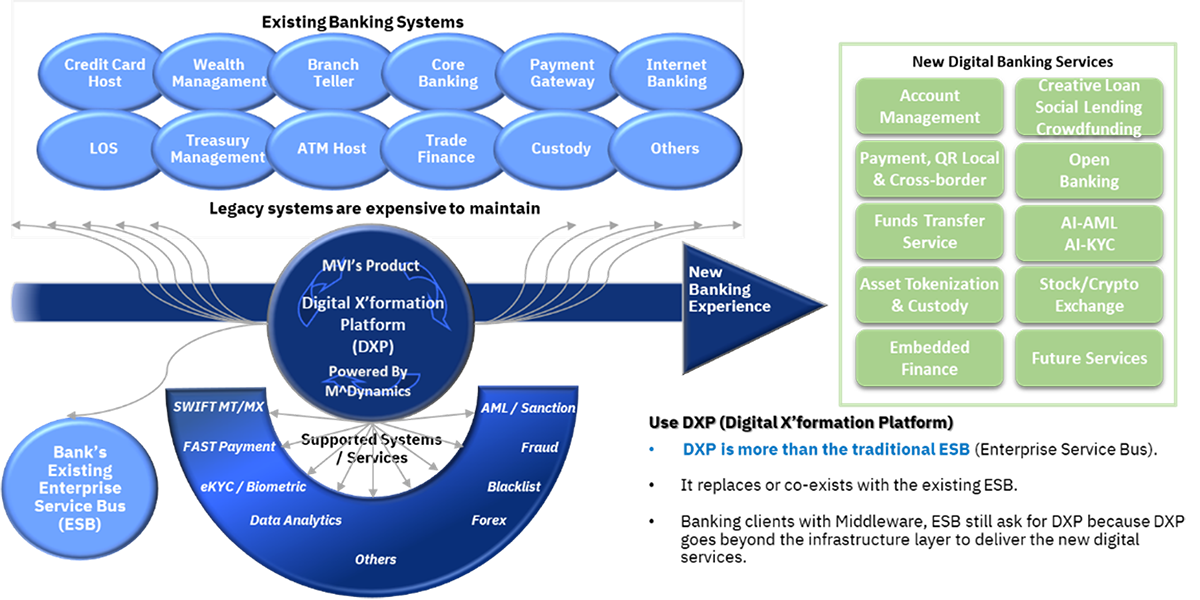

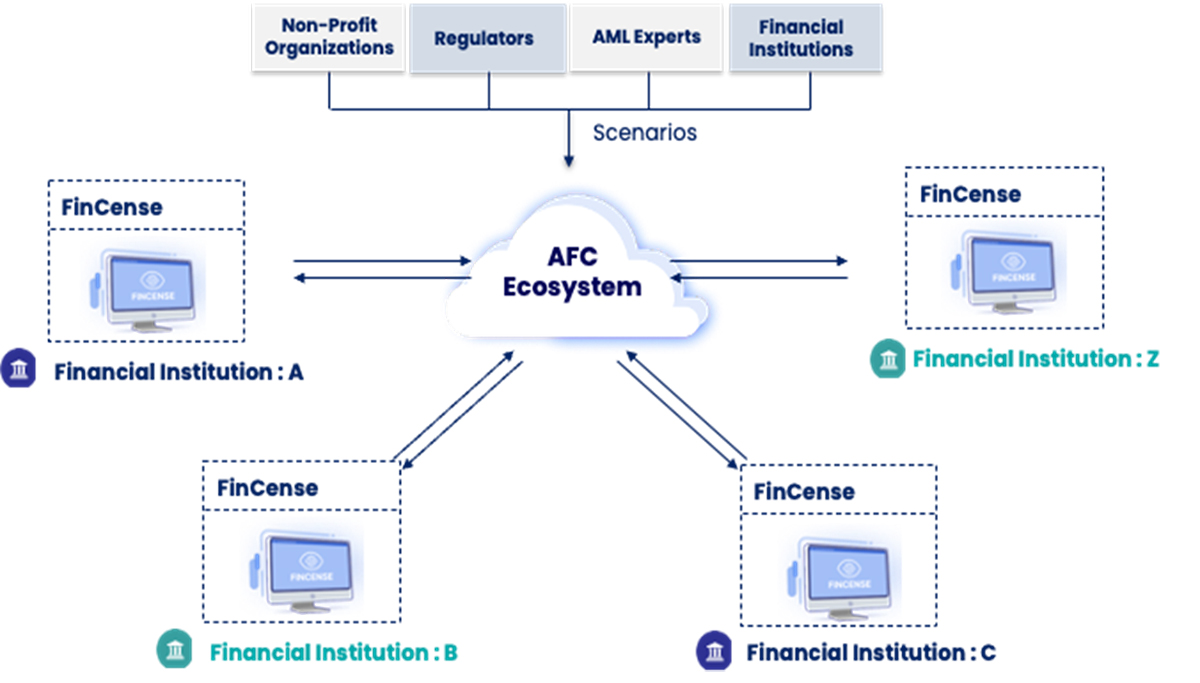

As the crypto and fintech landscape continues to grow, so does the need for safeguarding digital assets against unforeseen risks.

Anapi is proud to be one of the few brokers in Singapore who can get local insurers to cover crypto and blockchain-related clients for Crime, Professional Indemnity, Cyber or Director & Officers Insurance.

We work with insurers to cover crypto assets including your client's private keys under your custody and with a third-party custodian. For not only protection from physical damage and theft but also from employee fraud, external computer attacks, fraudulent instructions and error or omission. Providing businesses operating in the crypto space with greater financial stability and protection.

Who Needs This?

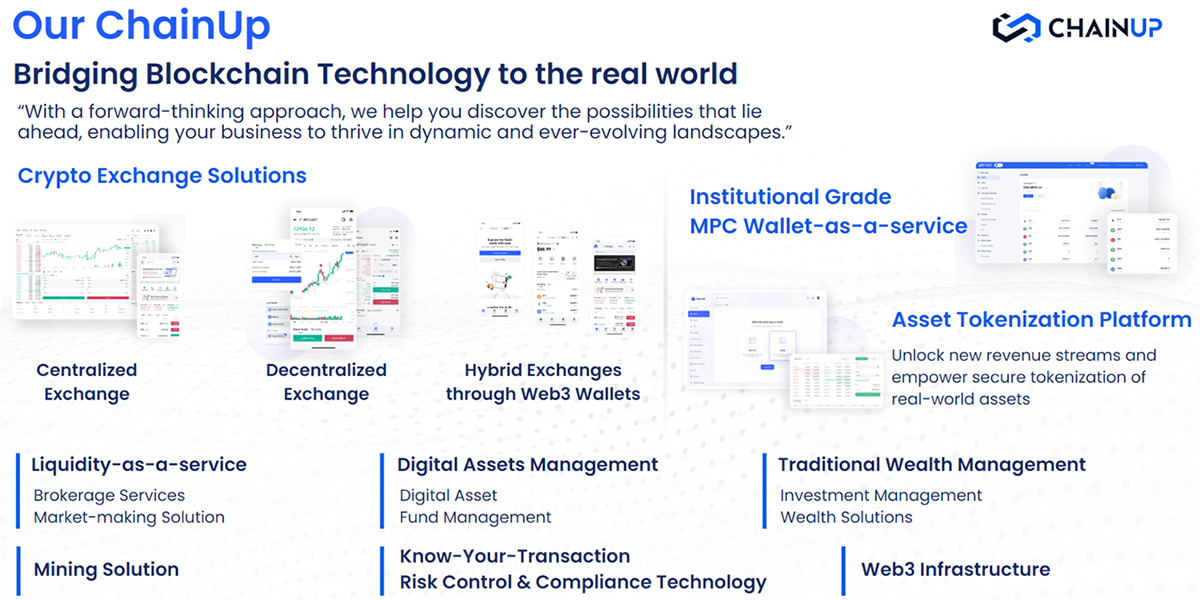

- Crypto Custodians and Exchanges

- Crypto off-ramps

- Fund managers, family offices with crypto assets

- Crypto trading companies and liquidity providers