We strive to create a community that connects, empowers, and inspires all individuals towards fostering a vibrant FinTech hub.

Advocate.

Collaborate.

Connect.

Our goal is to promote engagement in the FinTech ecosystem through events, membership programs, and knowledge sharing.

Why Join Us

Whether you are deeply ingrained in the FinTech world or are simply interested, everyone can find a home here.

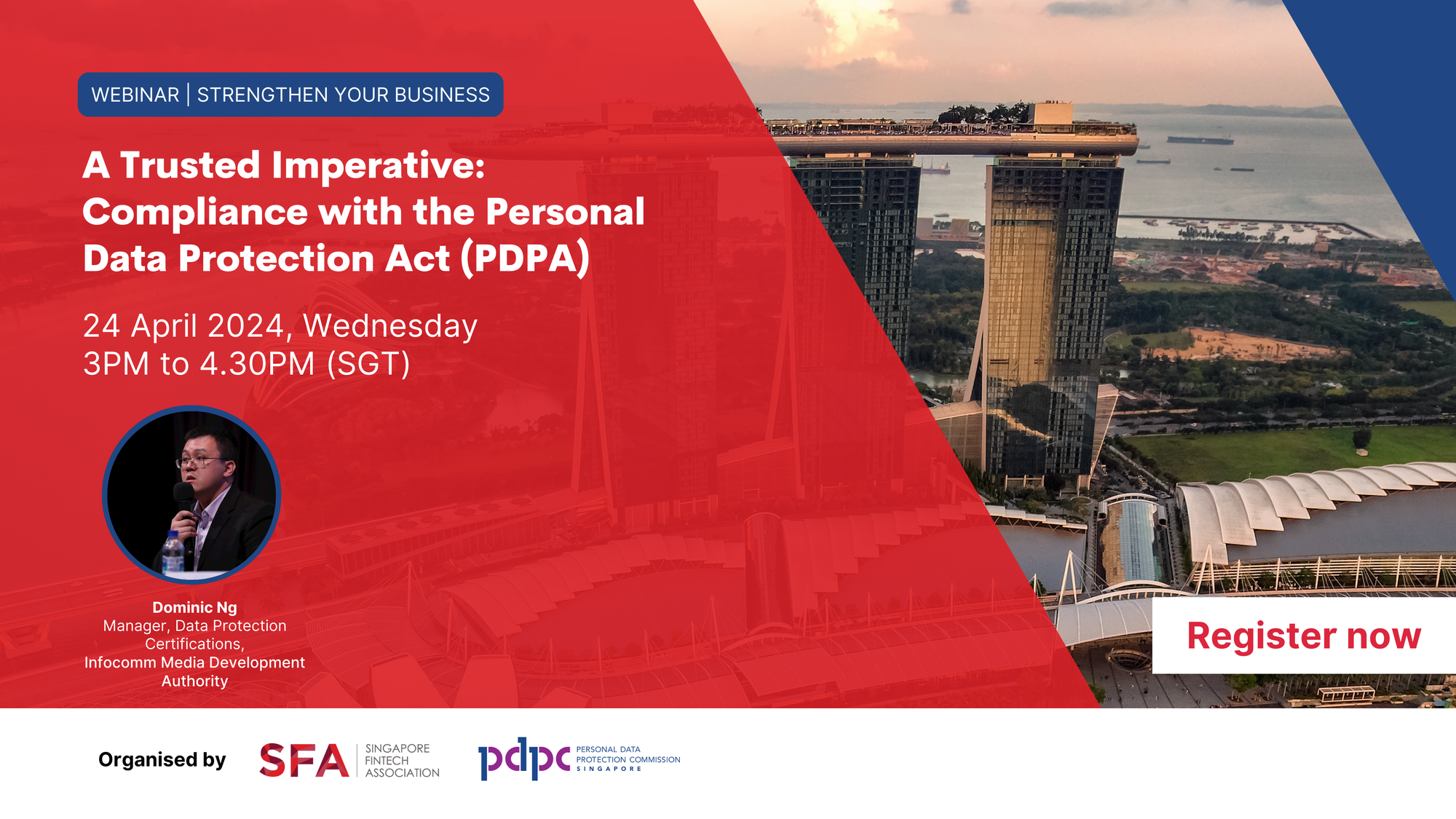

Upcoming Events

Empowering Web 3.0 Firms: Harnessing RegTech for Regulatory Compliance

-

2024-04-30

-

3pm

-

80 Robinson Rd, #08-01, Singapore 068898

Upcoming Events

Publications

FinTech in ASEAN 2023: Seeding the Green Transition

FinTech Talent Report 2023

Taking Stock & Looking Ahead: Gender Diversity in Southeast Asia's FinTech Landscape

FinTech Innovation in Singapore

Collaboration Lies At The Heart of Community Building

We have 10 subcommittees

ADVOCACY | CONVERSATIONS | RESOURCES | DEVELOPMENT

News And Press

Join SFA